Indigo Paints Ltd - Q3FY22 Analysis

- Shekhar Yadav

- Feb 16, 2022

- 6 min read

Updated: Apr 2, 2022

Indigo Paints Ltd saw margins improve after 2 quarters of decline owing to increase in cost and not being able to completely pass on the cost to end customers. While the industry beating growth continued with a quarterly revenue growth of 26.63%, the 9 month revenue growth stood at around 32%.

In this blog, I will cover:

Initiatives taken in Q3FY22 by the company

Indian Paint Industry updates

Indigo Paints Ltd- Change in distribution strategy

Financial Analysis

Comparison with its peers

Just to add, it is a treat listening to Mr Hemant Jalan, Founder & MD of Indigo Paints, learning about the Paint industry and various strategies to grow in a sector with very strong entry barriers.

Brief Profile: Indigo Paints Ltd

Founded in the year 2000, Indigo Paints Ltd, fifth largest paint company focused solely on decorative paints. Between FY10 & FY19, the company had grown by a CAGR of more than 40%.

All these does not come without struggle, the company was able to generate a revenue of just ₹10cr in the first 10 year of its operation. Then they started to try out different strategies for growth which gave them success.

I have written 2 blogs earlier on Indigo Paints, which you can read below:

Indigo Paints Ltd - Q3FY22 Analysis

Updates for the Quarter(Q3FY22):

During the quarter, Indigo Paints launched an innovative first of its kind “Anti-Odour’ paint, intended to absorb unpleasant odour in Kitchens and Bathrooms.

Company plans to launch more differentiated product in Q1FY23, resuming its high growth trajectory which was interrupted by COVID in the last 2 years.

In Dec'21, company launched a new advertisement campaign, "Jaisa Performance Waisa Price" intended to position the brand as a premium one. (Placed a clip at the bottom of this section)

Indigo Paints have entered the 2 last remaining states of Himachal Pradesh & Delhi.

Earlier company was serving the Delhi market from its Depot in Ghaziabad in U.P. Having not faced much resistance from the dealers there, the company has decided to set up a Depot in Delhi and also has setup a dedicated sales team for Delhi.

A depot at Hubli (Karnataka) was opened in October 2021

Expect to open a depot each at Himachal Pradesh & Delhi in Q4FY22

Indian Paint Industry : In larger cities, Brand equity plays a major role in doing the sales whereas in smaller towns and rural areas, the role of influencer is very important. Now, with the wide presence and aggressive advertising, 'Indigo Paints' brand is well known across India. So, they are now looking to grow in the larger cities.

Q4 is the best quarter for the company as they give annual incentives to dealers on reaching the sales target. Also, the sales of climate related products increases/ differentiated products.

In FY21, company spent 10.7% of sales on Advertisement and promotion.

During Q3, company's sales in Kerala saw strong growth, given the fact company derives 30% of its sales from Kerala.

Sales were impacted in some states due to delayed withdrawal of monsoon.

Company continued its advertising spends (including during the IPL in October) as part of its long term Brand building strategy.

The expansion of company's manufacturing facility in Tamil Nadu; expected to be complete by Q2FY23.

Indian Paint Industry : In the middle of third quarter, the industry as a whole took a price hike of 14-15% in 2 tranches. This helped them to mitigate the margin pressure imposed by increase in raw material costs. The full impact of this price hikes is expected to be visible in Q4FY22.

Indigo Paints Ltd : Distribution Network

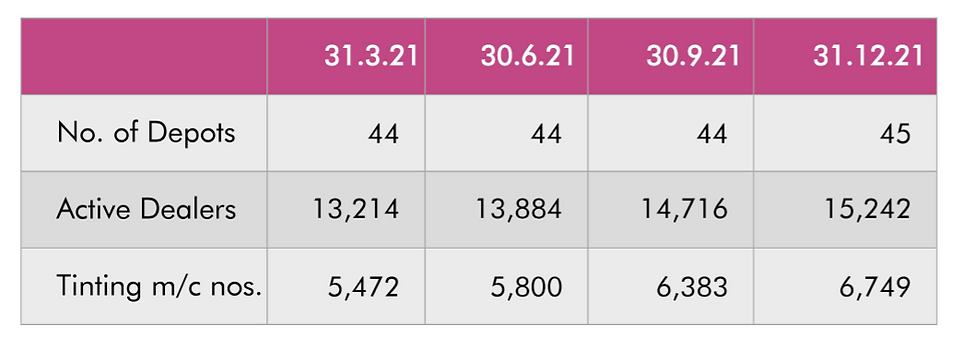

As of 31st December, Indigo Paint had 15,242 dealers. The management has set up an ambitious target of increasing the dealer count to 17,000 and number of tinting machine to be installed to be 7200 by 31st March 2022.

Also, now 44% of he company's dealers have tinting machine. Indian paint companies derive maximum value and revenue from emulsion paints which require tinting machine to create the numerous shades of paints.

To expand the distribution network , company has tweaked its distribution strategy.

Like its peers, Indigo Paints have stayed away from dealing with wholesalers in the past. They would set up Depots in places where they want to grow and serve the retailers/dealers directly from its depot.

Now, the company is trying to do something different from their own or industry norms which is going to the Wholesalers/distributors in those cities where the company has large count of active dealers to increase the outreach in distribution to smaller counters.

Another change in instance was that, many retailers are interested in just the differentiated product portfolio of Indigo Paints. Earlier the management of indigo paints was against retailers stocking just the differentiated products which contributes 30% of company's revenue.

But now they think they can start supplying these differentiated paints to the retailers. These can be served through wholesalers as well. The idea behind this could be that now the brand 'Indigo Paints' is well known and once the retailers start stocking company's differentiated products, over time they might start selling other products as well. In Q3FY22, this strategy has worked well for the company.

Indigo Paints Ltd : Financial Performance Analysis

Indigo Paints' Q3FY22 revenue grew by 26.63% YoY. The gross margin declined significantly on a year on year basis due to steep increase in raw material cost, but saw some improvement in quarter to quarter comparison. With the normalization of COVID scenario, company is confident on being back on its high growth trajectory.

Same goes with EBITDA margin, there was good improvement in Quarter on quarter margin.

With the aggressive distribution network expansion, the sales growth is expected to be robust while the other costs don't rise as much as sales do leading to expansion in its margins.

Indigo Paints' management has always been aggressive in A&P spend(Advertisement & Promotion) to create its brand equity. While the A&P spend was flat on a YoY basis, but doubled quarter on quarter and the management has indicated that they will now continue advertising aggressively.

For FY21, the company spent 10.7% of revenue towards A&P. And in Q3FY22, it was 11%.

Indigo Paints Ltd Vs Peers : Comparison

If you look at the table above, Indigo Paint is the latest entrant in the Indian Paint Industry which is guarded by very strong entry barriers. Other players in the business for a minimum of 60 years with the oldest being older than 100+ years.

Indigo Paints using its differentiated strategy has been able to grow faster than the market gaining market share from its competitors by following various strategies such as creating its own differentiated products (Metallic Emulsions, Tile Coat Emulsions, Bright Ceiling Coat Emulsions and Floor Coat Emulsions), focusing on rural and smaller towns growing via incentivizing the painters/retailers , advertising aggressively building brand equity etc. The idea behind getting into category-creator products and also value-added products was to just get in a foot into the industry.

Unlike its peers, Indigo Paints has Negative Cash conversion cycle. In addition, the company has healthy operating cash flow.

For Q3FY22 as well as historically, Indigo Paints' Gross margin is much better than its peers at 43% due to differentiated product portfolio but it does not boil down to better EBITDA margin due to company's aggressive A&P spending. As and when the scale/operating leverage kicks in, the margins are expected to move upward.

As you can see in the image above, all the paint companies trade at a very high valuation due to the high entry barrier in the Indian paint industry. So, does Indigo Paints. Now, given the growth trajectory the company is on, with the increase in revenue, the cost as a percentage of sales will not grow as proportionately leading to expansion in margin. As the revenue grows, the valuation will continue to grow. In the last 5 years, company has grown by 42% CAGR and during the 9MFY22, the sales grew by 32% amidst lockdowns and high raw material prices.

Also, post IPO in Feb 2021 at a price of ₹2600, the company has already seen its price correct by 27% as the Industry as a whole was faced with headwinds of COVID and steep increase in raw material prices.

Key Risk:

Entry of new players such as Grasim and aggressive expansion by JSW Paints.

Since about 75% of demand for decorative paints arises from repainting, which, in turn, depends heavily on the country’s economic conditions.

If the raw material price increase further, not sure how long market can absorb products at higher prices.

Comentários